Interest Rate Betting

It is vital for you to understand the way the market runs if you wish to place bets on interest rates effectively. You need to know ways on how prices are being quoted and how the whole interest rate betting works. It will be very vital for you to understand how to position the environment’s bond investments because when rates are decreased, the yield curve appears to be really normal. The bondholder will gain more interest if the maturity of the bond is much longer.There are normally two types of contracts you can spread bet on: short-term and long-term interest rates.

It is vital for you to understand the way the market runs if you wish to place bets on interest rates effectively. You need to know ways on how prices are being quoted and how the whole interest rate betting works. It will be very vital for you to understand how to position the environment’s bond investments because when rates are decreased, the yield curve appears to be really normal. The bondholder will gain more interest if the maturity of the bond is much longer.There are normally two types of contracts you can spread bet on: short-term and long-term interest rates.

Short-Term Interest Rates

Among the most liquid and well-known financial markets in the world are the short term interest rates. These rates permit you to defend your interest rate betting decision on the currency’s 3 month interest rates’ direction.People should purchase bond funds or bonds that have maturities that are shorter if they believe that the interest rates are going to increase soon.

Long-Term Interest Rates

The government bond’s price reflects long-term interest rates and this means that if you take a government bond position, you are trying to predict the interest rates’ direction. The bond futures permit individuals to place a bet on the long-term interest rates’ direction. Because bond prices increase when interest rates decrease, you need to purchase these contracts in case you expect that the important interest rates will decrease and sell them if you expect them to increase.

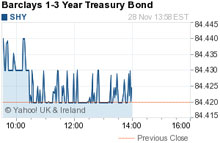

You’ll be missing out on gaining a higher yield if you continue waiting for the rates to increase. If a person thinks that the rates are going to decrease, he should purchase bond funds or bonds that have maturities that are longer. There are two advantages if you are going to purchase bonds that have longer maturities. The first advantage is that the bond’s value will dramatically rise as rates decrease. For instance, a usual bond fund that is long-term will have a 15 to 20 percent value increase with a 1 percent interest rate move. The second advantage is that contrary to those funds that have a shorter term, you will gain a higher yield with this method. The Barclays 20 Year Treasury Bond Fund (TLT) is one popular example of this long term bond fund. The issue with this kind of method is that if the rates increase instead of decreasing, you might encounter massive losses. Purchasing bonds that have maturities that are longer will also add the volatility of your portfolio as compared to those that have maturities that are shorter.

You’ll be missing out on gaining a higher yield if you continue waiting for the rates to increase. If a person thinks that the rates are going to decrease, he should purchase bond funds or bonds that have maturities that are longer. There are two advantages if you are going to purchase bonds that have longer maturities. The first advantage is that the bond’s value will dramatically rise as rates decrease. For instance, a usual bond fund that is long-term will have a 15 to 20 percent value increase with a 1 percent interest rate move. The second advantage is that contrary to those funds that have a shorter term, you will gain a higher yield with this method. The Barclays 20 Year Treasury Bond Fund (TLT) is one popular example of this long term bond fund. The issue with this kind of method is that if the rates increase instead of decreasing, you might encounter massive losses. Purchasing bonds that have maturities that are longer will also add the volatility of your portfolio as compared to those that have maturities that are shorter.

In the next few years, interest rates are said to stay stable. Because of this, there are some strategies that you should do. The first one is to purchase intermediate bond funds as this gives a good yield balance as compared to those funds that are short term and it provides a volatility that is moderate as compared to funds that are long term. Another approach for interest rate betting is to purchase individual bonds and gain money from going down on the yield curve. The yield curve’s shape is something this method takes advantage of.